How Blockchain Will Revolutionize Banking, Financial Services, and FinTech

In the ever-evolving landscape of finance, blockchain technology stands as a disruptive force, poised to reshape banking, financial services, and FinTech. As we delve into the transformative potential of blockchain, we witness a paradigm shift, promising enhanced security, transparency, and operational efficiency. In this article, we explore the current state, future trends, challenges, and strategies surrounding blockchain in the financial sector.

Understanding Blockchain Technology in Finance

At its core, blockchain is a decentralized ledger system recording transactions across multiple nodes, ensuring transparency and immutability. The absence of intermediaries enhances security, a critical aspect in an era marked by data breaches and cyber threats.

Significance of Blockchain in Finance

Blockchain’s significance lies in its ability to deliver heightened security and transparency, making it a game-changer in the financial sector. The cryptographic protection ensures tamper-proof records of all transactions, mitigating the risk of fraud and establishing an unassailable financial record.

Current Applications of Blockchain in Finance

Blockchain’s impact is already evident in various financial applications:

1.Cross-Border Payments and Remittances:

2.Trade Finance and Supply Chain Management:

3. Digital Identity and KYC Verification:

4. Tokenization of Assets:

5. Decentralized Finance (DeFi):

6. Smart Contracts in Legal and Financial Agreements:

Benefits of Blockchain Adoption in Finance

1. Effortless and Timely Transactions:

2. Operational Effectiveness & Cost Reduction:

3. Higher Level of Security & Immutable Transactions:

4. Economic Accessibility & Inclusion:

5. Transparency & Regulatory Compliance:

6. Smooth Cross-Border Transactions:

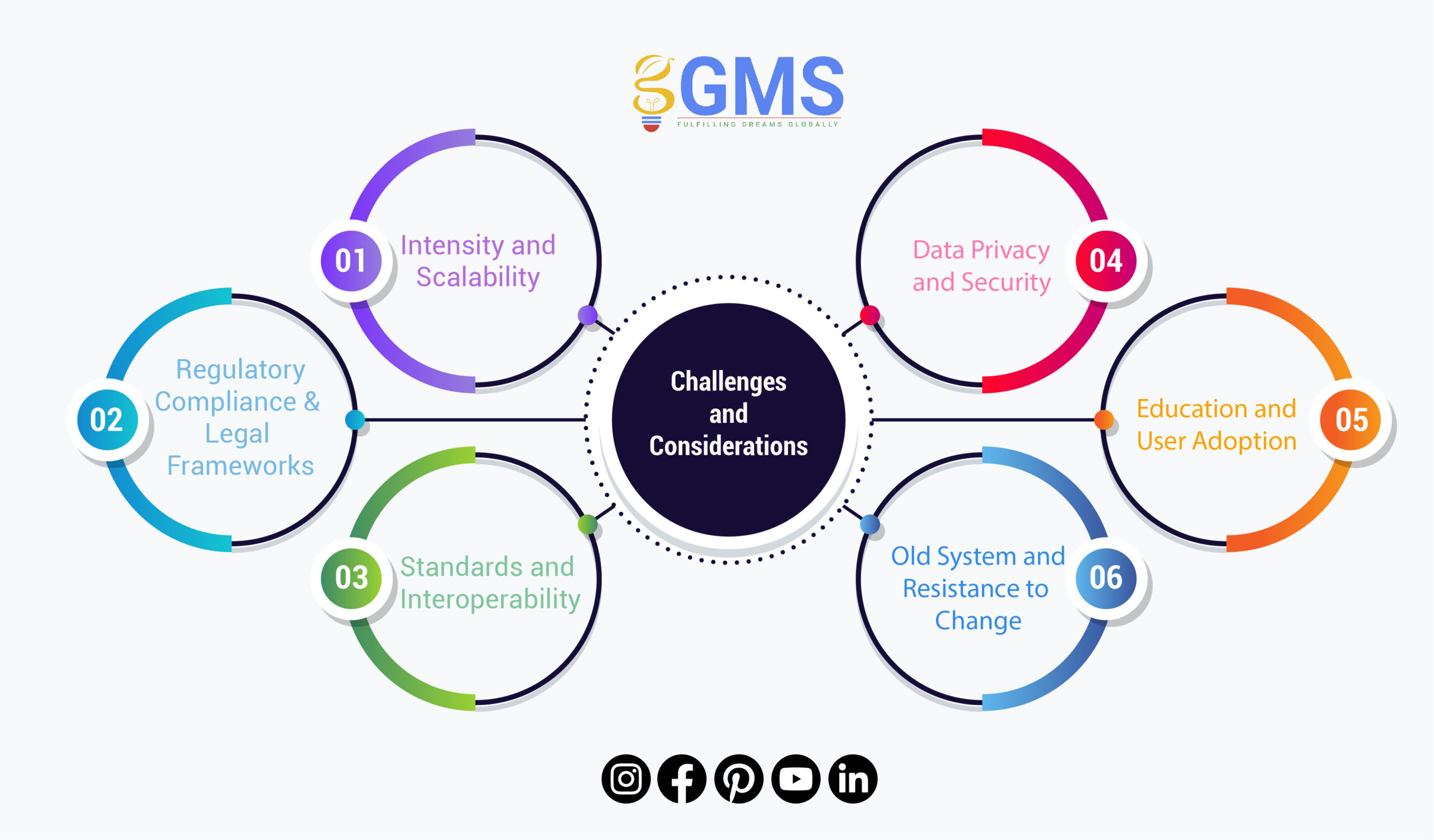

Challenges and Considerations of Blockchain in Finance

1. Intensity and Scalability:

2. Regulatory Compliance & Legal Frameworks:

3. Standards and Interoperability:

4. Data Privacy and Security:

5. Education and User Adoption:

6. Older Systems and Resistance to Change:

Future Trends and Innovations of Blockchain in Finance

1. Decentralized Finance (DeFi) Revolution:

2. Central Bank Digital Currencies (CBDCs):

3. Tokenization of Assets:

4. Smart Contracts Evolution:

5. Solutions for Greater Scalability:

6. Cross-Chain Integration:

7. Improvements in Security and Privacy:

8. Green and Sustainable Blockchain:

Strategies for Financial Institutions and FinTech

1. Lean toward a Collaborative Ecosystem:

2. Invest in Research and Development:

3. Develop a Blockchain-Centric Strategy:

4. Give Regulatory Compliance and Standards a Top Priority:

5. Concentrate on User Adoption & Awareness:

6. Adopt Strong Security Measures:

7. Culture of Experimentation and Innovation:

8. Monitor and Adapt to Technological Advancements:

Risks to Implement Blockchain in Finance

1. Security Vulnerabilities:

2. Challenges with Regulation and Compliance:

3. Scalability and Performance Concerns:

5. Interoperability Issues:

6. Legal and Governance Considerations:

7. Data Privacy and Compliance:

8. Vendor Lock-In and Platform Risks:

FAQ

How does blockchain enhance the security of financial transactions?

Blockchain ensures security through its decentralized and tamper-resistant ledger, making transactions tamper-proof and immutable.

What are the key applications of blockchain in finance?

Blockchain applications in finance include cross-border payments, trade finance, digital identity, tokenization of assets, decentralized finance (DeFi), and smart contracts.

How does blockchain contribute to financial inclusion?

Blockchain facilitates access to financial services in underserved regions through digital wallets and decentralized finance (DeFi) applications.

What challenges does blockchain face in the financial industry?

Challenges include scalability issues, regulatory compliance complexities, interoperability concerns, data privacy considerations, and resistance to change from legacy systems.

What are the future trends in blockchain and finance?

Future trends include the rise of decentralized finance (DeFi), the exploration of Central Bank Digital Currencies (CBDCs), increased tokenization of assets, and advancements in smart contracts.

How can financial institutions enhance user adoption of blockchain-based solutions?

Financial institutions can enhance user adoption through effective education and awareness campaigns, providing clear information about the benefits and functionalities of blockchain.

What strategies should financial institutions adopt for successful blockchain integration?

Strategies include fostering collaborative ecosystems, investing in research and development, developing a blockchain-centric strategy, prioritizing regulatory compliance, and concentrating on user adoption and awareness.

What security measures should be implemented for blockchain transactions?

Robust security measures, including encryption, multi-factor authentication, and continuous monitoring, should be implemented to guard against potential security risks.

How does blockchain address the challenges of cross-border transactions?

Blockchain technology accelerates cross-border transactions, making them more affordable, quicker, and error-free compared to traditional systems.

What risks are associated with implementing blockchain in banking and FinTech?

Risks include security vulnerabilities, challenges with regulation and compliance, scalability and performance concerns, interoperability issues, legal and governance considerations, data privacy and compliance challenges, and the risk of vendor lock-in and platform obsolescence.

Conclusion

As we stand on the precipice of a transformative era in finance, the potential of blockchain to revolutionize banking, financial services, and FinTech is undeniable. However, successful integration requires strategic partnerships, continuous innovation, and careful navigation of challenges. Financial institutions and FinTechs that embrace a blockchain-centric future, invest in research, and collaborate with the right partners will lead the way toward a more secure, transparent, and efficient financial ecosystem.